Originally published August 9, 2011

Institutional Capture is a fancy name for a simple concept. It is a label for the phenomena where an employee becomes focused on her own personal agenda and forgets (or intentionally circumvents) the objectives of the organization. And yes, it happens in large organizations more commonly than in small ones, but the differences between large and small entities as not as great as it is in other areas of inefficiency.

Of the various corporate efficiency diseases, this one is pervasive. In fact, it is so common that companies design systems to align personal agendas with corporate strategies. These systems include things like: accounting segregation of duties, incentive systems craftily designed to produce specific behaviors, corporate ethics officers and whistleblower policies, and many other, similar things.

Even with all this effort, the systems are still woefully inadequate. Why? They buck human nature and are too cumbersome to respond to changes in priorities among individual employees.

Building a Career, not a Company

A sizable percentage of Institutional Capture problems arise over the fact that the best course of action for the company is not necessarily the best course of action for the individual. In a world where the company’s commitment to the employee (and vice versa) has ebbed to a very low level, it isn’t difficult to understand why a person looks out for her own interests first.

People tend to be remarkably adept at figuring out what’s best for their career and following that path, pushing Corporate Strategy (not to mention policies and procedures) aside. And if they are successfully sold on the company story, a few instances where they take it on the chin for acting in the company’s interest will likely modify their behavior. The system is almost designed to put “Institutional Capture” in the forefront.

In one organization where I worked, the unwritten (but well understood) company policy was… “Executives are yelled at for missing sales targets, but they are fired for missing profit percentage targets.”

This reality pervaded many decisions and actions taken by managers on a daily basis. Think about it. If, as a senior divisional manager, you have an opportunity to make a large sale at lower than average margins, would you do it? Financial analysis probably says that the project will be marginally profitable and should be taken, but the execs quickly realize that the sale blends down margins, resulting in dire consequences. In this particular company there was no question about which way that decision would go.

While I worked at this firm there was a major push from Corporate Headquarters to source product from sister divisions. Plenty of corporate profit was going into the hands of third party suppliers because we couldn’t seem to work with each other. The truth, of course, was that this was another example of Institutional Capture.

As part of this initiative, inter-divisional sales were measured, regularly reported on, and the less-than-stellar results became a subject to repeated lectures. Eventually, incentive programs were realigned. We even had outside “experts” brought in to identify opportunities (which everyone already knew about) and to calculate potential Corporate savings (which no one in the divisions cared about).

Behaviors, however, largely didn’t change.

The realization that it was an executive’s highest order personal interest to protect their profit margins never seemed to dawn on the corporate staff. Unless and until they changed the “…people get fired for missing profit margin targets” reality, it would have been foolish for executives to act any other way. While I worked there, the corporate staff never seemed able to grasp this point.

That’s an example of systemic Institutional Capture, but often the phenomena is much more personalized.

An acquisition made in a destination location, one which ends up being the justification for a CEO’s regular and frequent “visits” is a more personal example. As is a project that will look good on an executive’s resume, despite the fact that it isn’t strictly justifiable. I’ve even seen entire business units disposed of simply because an executive was too challenged (or lazy) to be bothered with understanding it.

Size matters, but only to a degree

As organizational size increases, the understanding of the Corporation’s objectives and interests become harder for individual employees to grasp. This is another aspect of Institutional Capture. And large organizations are faceless and impersonal. Eventually, employees begin to feel that by succumbing to their personal interests, they are betraying a monolithic creature rather than actual people (the individual shareholders.) The investors and their personal interests (and the injuries they suffer) become distant to employees – even to senior executives – while their own interests are normally nearby and loud.

While working for one employer (a public company,) I sat in stunned silence as the CEO and another senior manager dispassionately discussed the possibility of taking the company private. It seemed to bother neither of them that the talk was essentially treasonous – the substituting of their own interests for that of the shareholders. After all, a buyout only works if the management team thinks there is more value to (readily) capture than what they will have to offer current shareholders. And while the notion was rejected over practical matters (there didn’t seem to be enough excess value to capture,) I have little doubt that if the transaction had “worked” the company would now be privately owned.

It wouldn’t be a stretch to call every such privatization transaction an example of Institutional Capture.

People often simply don’t recognize the clashing of their personal interests with those of the company, and when they do they have an amazing ability to rationalize their behaviors. In most cases of Institutional Capture, the employees should have plenty of reason to question whether what they are contemplating is wrong. Instead they tell themselves that… "They owe it to me because...", "Nobody will miss it...", "My need outweighs the company's greed...." These are a few examples of the internal rationalization that goes on in the minds of individuals as they are crossing the line.

I find this concept fascinating, and it is at the core of several of my novels -- the large, faceless organization and the employee who is looking out for his or her own interests. The stories typically follow a slide down the slippery slope; and consequent attempts to either hide the improper actions or justify them as somehow in the company's interests. Institutional Capture is the primary cannon fodder for my writing.

Is small really different?

Usually a smaller organization can avoid these kinds of problem, but not always. To wholly avoid Institutional Capture, owners need to be involved in what’s going on in the business on a day-to-day basis. While small companies provide fewer corners for Institutional Capture to lurk, when owners aren’t attentive they can be just as bad.

A small company I recently investigated was loaded with examples of Institutional Capture. The company had four owners, but only one was actively engaged in the business. The active owner was busily occupied in diverting company resources to take care of his personal expenses and projects – to the detriment of the other owners. It was a prime example of what one of my former bosses called “the confusion of company and personal assets,” a form of Institutional Capture.

At the same time, the managing owner wasn’t paying attention to what was happening on the shop floor, creating another opportunity for Institutional Capture. This business had a substantial amount of daily “walk in” business, which employees were performing on their own behalf while utilizing company assets and raw materials. Technically, this was theft, but a theft essentially sanctioned by the lack of attention of senior management.

It was also another form of Institutional Capture.

Summary

Institutional Capture can be a huge problem in organizations both large and small, and is one of the most efficiency-destructive forces out there. The term “Institutional Capture” doesn’t refer to the various kinds of aberrant behavior experienced within an organization, but instead describes the structural inadequacies that pit company interests against personal ones in a way that pretty much assures that the company loses

No matter how careful an organization is, it is likely that some Institutional Capture exists. The associated inefficiency can be minimized by detailed alignment of goals, incentives, and penalties, and through consistent and careful oversight.

Posts in the “Corporate Inefficiency” Series (Chronological Order)

- Classic: Corporate Inefficiency

- Classic: Corp Inefficiency, Sunk Costs

- Classic: Corp Inefficiency, Groupthink

- Classic: Corp Inefficiency, Compliance vs. Management

Posts in the “Behaviors Managers Hate” Series (Chronological Order)

- Classic: Behaviors Managers Hate, Overview

- Classic: Behaviors Managers Hate, Fairness

- Classic: Behaviors Managers Hate, Blinders

- Classic: Behaviors Managers Hate, Entitled

- Classic: Behaviors Managers Hate, Performance Cluelessness

- Classic: Behaviors Managers Hate, Business Cluelessness

- Classic: Behaviors Managers Hate, Blaming

- Classic: Behaviors Managers Hate, Hiding

- Classic: Behaviors Manager hate, Suggesters

- Classic: Behaviors Managers Hate, Clock Watchers

To find other blog posts, type a keyword into this search box, or check my Blog Index…

My LinkedIn profile is open for your connection. Click here and request to connect. www.linkedin.com/in/tspears/

If you are intrigued by the ideas presented in my blog posts, check out some of my other writing.

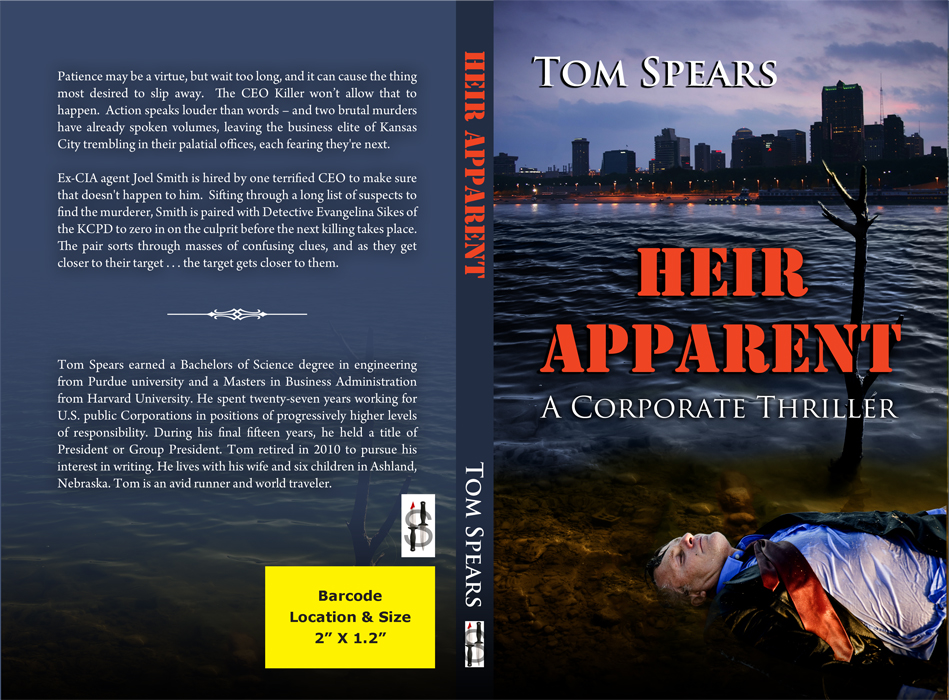

Novels: LEVERAGE, INCENTIVIZE, DELIVERABLES, HEIR APPARENT, PURSUING OTHER OPPORTUNITIES, and EMPOWERED.

Non-Fiction: NAVIGATING CORPORATE POLITICS

To the right is the cover for HEIR APPARENT. Someone is killing corporate leaders in Kansas City. But who? The police and FBI pursue a "serial killer" theory, leaving Joel Smith and Evangelina Sikes to examine other motives. As the pair zero in on the perpetrator, they put their own lives at risk. There are multiple suspects and enough clues for the reader to identify the killer in this classic whodunnit set in a corporate crucible.

My novels are based on extensions of 27 years of personal experience as a senior manager in public corporations.